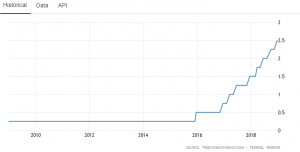

The market value of real estate is closely tied to the cost of money. As interest rates increase, so do the investment expectations of real estate investors. Overall, capitalization rates for an investment in commercial real estate have stayed at very low levels over the past decade. In great part, the cost of funds for investment has remained very low. One of the best indicators of the cost of funds is reflected in the federal funds rate. As shown on the table, the cost of money to lending institutions remained at 0.25% for seven years. Recently, the federal government elected to increase this rate to its current level of 2.5% with several bumps over the past two years. As the cost of funds increase, most investors look for increasing yield and overall capitalization rates in most types of commercial real estate.

Central and Northeastern Pennsylvania’s Real Estate Appraisal Experts.

Over the past 40 years and beyond, Real Estate Appraisal & Marketing Services, Inc. has provided clients in Central and Northeast Pennsylvania with over 25,000 residential and 8,000 non-residential appraisal reports. As a result, we know the area best. Our comprehensive reports are trusted by financial institutions, judicial systems, and developers. When you partner with us, you will receive timely and complete reports. Ultimately, nobody else compares to Real Estate Appraisal & Marketing Services, Inc. in Central and Northeast Pennsylvania.